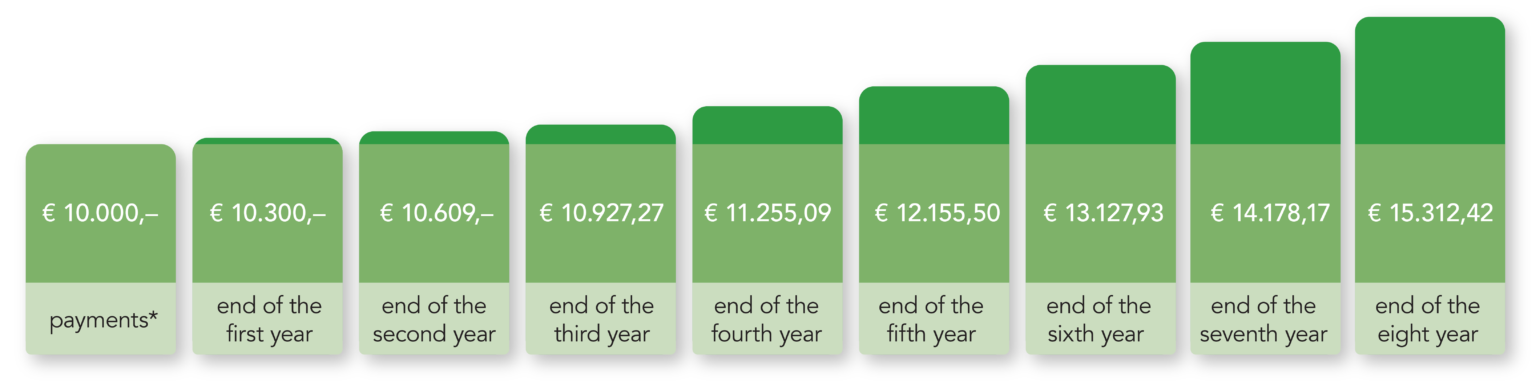

Nonbinding sample calculation

*for subscription date 01 July 2023

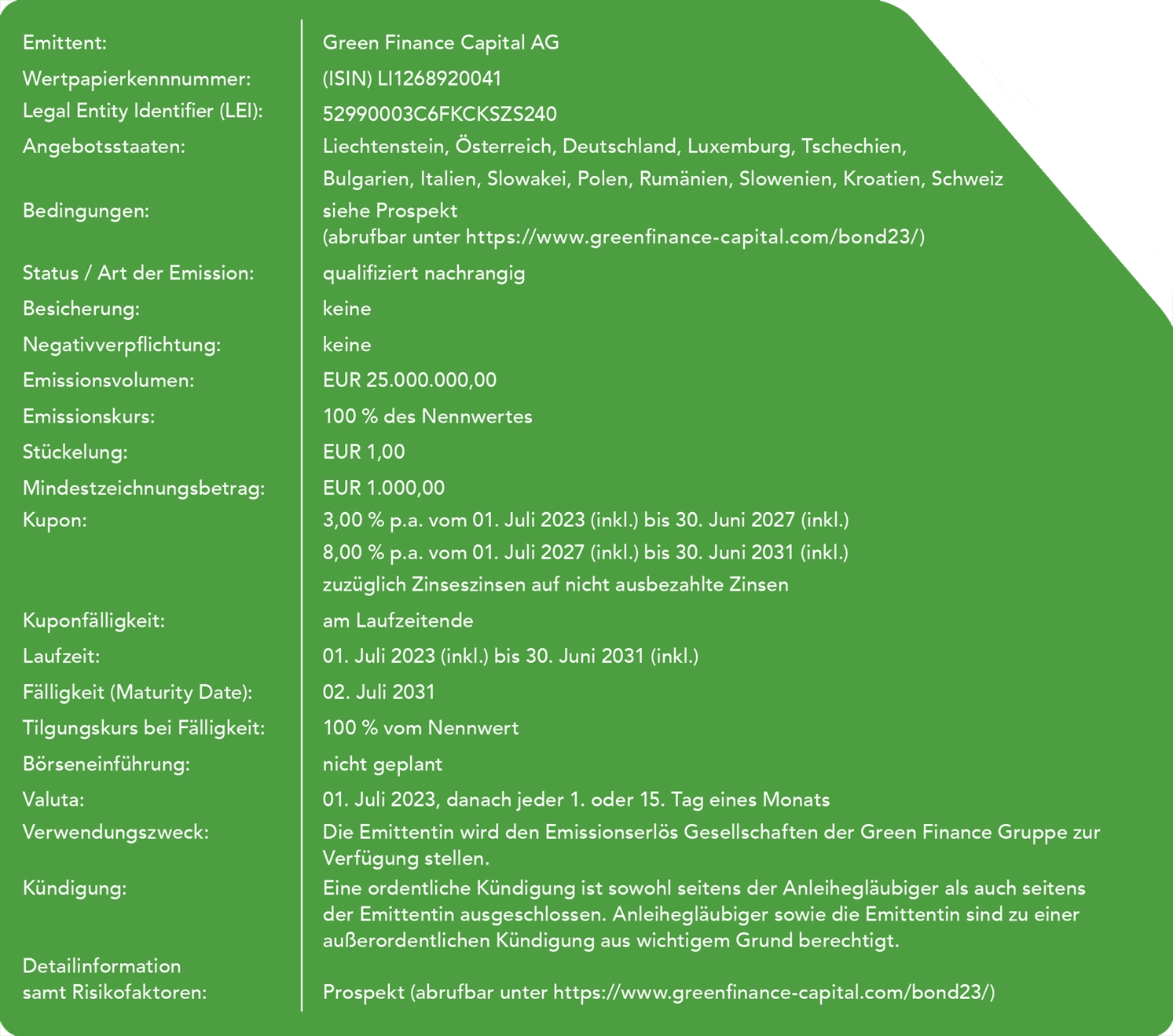

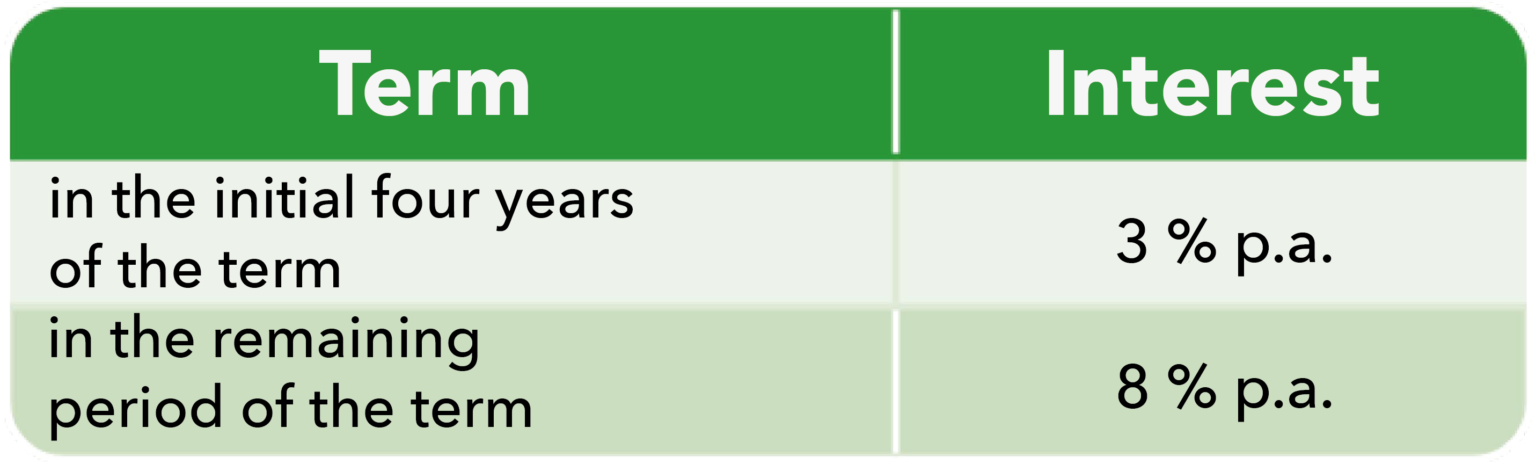

The projected return is not guaranteed and may also be lower. The Bonds have a bullet maturity, which means that both the capital invested and the interest (including compound interest) are only due for payment at the end of the term (or in the case of early redemption in the event of termination for cause ). This can lead to the compound interest effect described below. However, a complete loss of the capital invested, as well as the interest and compound interest, is also possible. Due to the bullet maturity and the qualified subordination of the investor’s claims against the Issuer (principal and interest including compound interest), the repayment of the principal and the payment of interest including compound interest also depend, inter alia, on the credit standing of the issuer in the end of the term or the date of maturity in the event of early repayment. Any tax is neither taken into account nor deducted in the sample calculation.